Imagine a world where the artificial intelligence that powers your chatbot isn’t just trapped in a server rack, but is walking into your kitchen to unload the dishwasher. This isn’t science fiction anymore. It’s Physical AI—the defining technological shift of 2025 and 2026.

While 2023 was the year of Generative AI (think ChatGPT) and 2024 saw the rise of video models, 2026 is officially the year AI gets a body. From Tesla’s factory floors to the living rooms of early adopters, algorithms are stepping out of the screen and into the physical world. But what does this mean for the economy, your job, and your daily life?

In this deep dive, we explore the explosive rise of Physical AI, the key players like Tesla and Figure AI, and the multi-billion dollar race to put a robot in every home.

What is Physical AI? (And Why It’s Different)

Physical AI (often called Embodied AI) refers to artificial intelligence systems that interact directly with the physical world through sensors and actuators. Unlike a chatbot that lives on a screen, Physical AI perceives its environment, makes real-time decisions, and executes physical actions.

Think of it as the marriage between the “brain” (Foundation Models like GPT-4 or NVIDIA’s GR00T) and the “body” (humanoid hardware).

The “VLA” Revolution

The industry has moved beyond simple programmed movements. We are now in the era of Vision-Language-Action (VLA) models.

- Vision: The robot sees a pile of laundry.

- Language: It understands the command, “Fold the blue shirts.”

- Action: It calculates the physics, friction, and movement required to manipulate the cloth without tearing it.

Industry Insight: As of early 2026, the shift has moved from “hard-coded” robotics (where every movement is programmed) to “end-to-end learning,” where robots learn tasks by watching videos of humans, much like a child learns by observation.

The Titans of 2026: Who is Leading the Race?

The market is no longer just research labs; it’s a commercial battlefield. Here are the frontrunners defining the landscape in 2026.

1. Tesla (Optimus Gen 3)

In a bold pivot, Tesla announced in January 2026 that it is winding down production of the Model S and X to retool its factories for the Optimus Gen 3.

- Status: Mass production slated for late 2026.

- Target Price: Eventually aiming for $20,000 – $30,000.

- Key Feature: The “infinite money glitch”—Musk’s claim that a robot labor force will decouple economic growth from demographics.

2. Figure AI (Figure 03)

After the success of Figure 02 in BMW manufacturing plants, Figure AI launched the Figure 03 in late 2025.

- The Brain: Powered by the Helix neural network, allowing it to “reason” through complex tasks.

- Partnerships: Deep integration with manufacturing giants to automate dangerous warehouse jobs.

3. Unitree Robotics (The G1)

While others promise future bots, Unitree is shipping now. The Unitree G1 has become the darling of researchers and developers.

- Price: Starting around $16,000.

- Capability: A compact, acrobatic humanoid that can fold into a suitcase. It’s currently the most accessible entry point for Physical AI development.

4. NVIDIA (Project GR00T)

NVIDIA isn’t building the body; they are building the brain. Project GR00T is a general-purpose foundation model for humanoid robots.

- The Ecosystem: Through Isaac Lab, NVIDIA allows developers to train robots in a digital “gym” (simulation) before uploading the skills to a physical robot, accelerating learning speeds by 1000x.

By the Numbers: The Market Explosion

The data confirms that we are at a tipping point. Investors are pouring billions into “embodied intelligence,” betting that robots will be bigger than the automotive industry.

| Metric | Projection | Source |

| Market Size (2030) | $39.6 Billion | KBV Research |

| Market Size (2035) | $103 Billion | Roots Analysis |

| CAGR (Growth Rate) | 47% – 52% | Various Industry Reports |

| Unit Sales (2026) | Limited “Beta” releases (1,000s of units) | Industry Analysts |

Why the surge?

- Labor Shortages: Manufacturing and logistics face chronic worker shortages.

- Aging Population: Japan and Western Europe desperately need automated care for the elderly.

- AI Convergence: The “brain” (LLMs) finally got smart enough to control the “body.”

Real-World Applications: Beyond the Factory Floor

While the factory is the beachhead, the home is the ultimate frontier.

1. The Home Butler (Beta Phase)

Companies like 1X (NEO) are designing robots specifically for safe human interaction in the home.

- Tasks: Unloading dishwashers, folding laundry, and tidying up toys.

- Current Reality: In 2026, these are mostly in “beta” households. They are slow, cautious, and require supervision, but they work.

2. “Dark” Logistics

Warehouses are increasingly becoming “lights-out” operations. Humanoid robots can work alongside existing infrastructure (stairs, shelves designed for humans) without needing to rebuild the entire warehouse for automation.

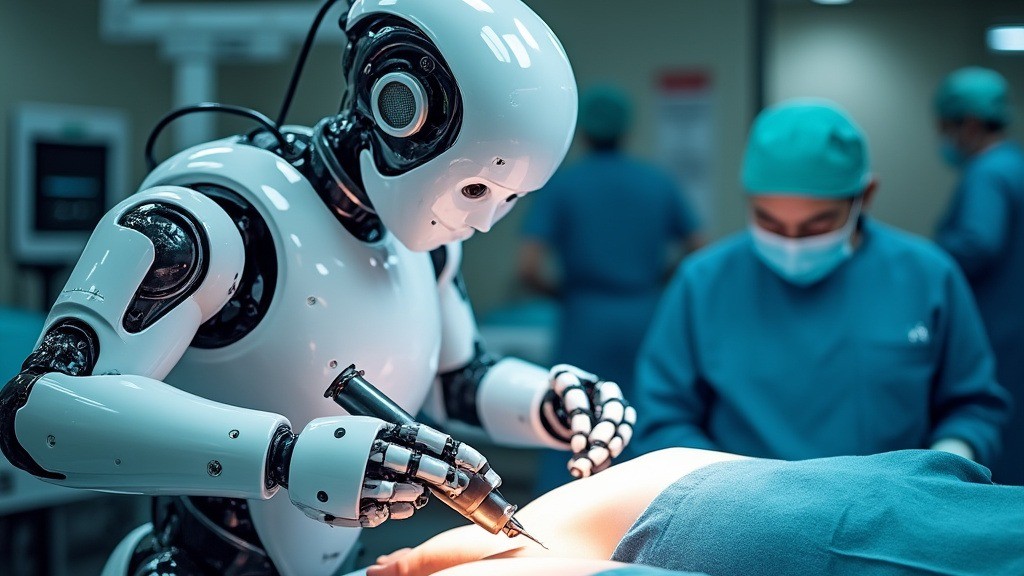

3. Eldercare and Healthcare

Robots like the Unitree H1 and upcoming dedicated care bots are being tested to assist with mobility, fetch items for bedridden patients, and provide monitoring, alleviating the burden on nurses.

The Roadblocks: Challenges to Adoption

Despite the hype, mass adoption faces significant hurdles.

- The “Black Box” Problem: If a robot drops a plate or bumps into a child, we need to know why. End-to-end neural networks are notoriously opaque, making safety certification difficult.

- Power & Battery Life: Most current humanoids only run for 2-4 hours on a charge. For a full workday, battery density needs to improve.

- Cost vs. Utility: At $20k+, a robot is a luxury car without wheels. It needs to provide significantly more value than a dishwasher to justify the cost for average consumers.

Conclusion: The “iPhone Moment” for Robotics?

We are currently in the “Blackberry phase” of Physical AI—functional, expensive, and business-focused. However, with Tesla’s massive manufacturing pivot and NVIDIA’s software acceleration, the “iPhone moment”—where utility becomes seamless and mass adoption begins—is likely approaching around 2028-2030.

Actionable Takeaways for 2026:

- For Investors: Look beyond the hardware. The software platforms (like NVIDIA’s Isaac or dedicated robot OS makers) are the picks and shovels of this gold rush.

- For Business Leaders: Audit your physical workflows. If a task is “dull, dirty, or dangerous,” it will be automated by a humanoid within 5 years. Start pilot programs now.

- For Enthusiasts: If you have $16k and coding skills, the Unitree G1 is your entry ticket. For everyone else, watch for Tesla’s 2026 rollout to see if the promises match reality.

Frequently Asked Questions (FAQ)

1. How much will a humanoid robot cost in 2026?

Prices vary wildly. The Unitree G1 starts around $16,000 for developers. High-end research bots like Figure 02 or Boston Dynamics’ Atlas are in the $100,000+ range (mostly lease-only). Tesla targets a future price of $20,000, but initial units will likely be higher or internal-only.

2. Can Physical AI robots really do household chores?

Yes, but with caveats. In 2026, robots can perform specific tasks like folding laundry or loading a dishwasher, but they are slow compared to humans. They currently struggle with “edge cases”—like a sock turned inside out or a cluttered floor they haven’t seen before.

3. Will robots take my job in 2026?

In 2026? Unlikely. Robots are currently augmenting labor in manufacturing and logistics where there are worker shortages. However, the long-term trend (2030+) suggests significant disruption in manual labor, driving a shift toward robot supervision and maintenance roles.

4. Is it safe to have a humanoid robot in my house?

Safety is the #1 priority. Modern “cobots” (collaborative robots) use force sensors to stop immediately if they touch a human. However, widespread home adoption is still regulated, and most “home” bots in 2026 are part of controlled beta programs to ensure safety protocols are bulletproof.